The Coronavirus: A Litmus Test for Insurance?

0 April 28, 2020 at 12:26 pm by Steve Kaukinen The immediate and direct effect of Covid-19 on the insurance industry is obvious and broad reaching. For many reasons, insurers must consider their ability to operate during the pandemic as an indication of their preparedness for the future.

The immediate and direct effect of Covid-19 on the insurance industry is obvious and broad reaching. For many reasons, insurers must consider their ability to operate during the pandemic as an indication of their preparedness for the future.

From claims implications from coverage to non-coverage to the financial uncertainty caused by direct coronavirus claims to lower claims frequency from lessened economic and human activity. Direct claims impacts are yet fully unknown and with legislators playing with retrospective coverage may not be known for some time. Few predict a happy ending. At first blush lower claims is good, however, that equals lower premiums in the long run, which would be very bad for most insurers who are dependent on a stable economic base to support their largely human work processes. For example, if an insurer has built up a workforce of 10,000 employees based upon a stable economy that has delivered 50 years of gradual growth, how do they support that workforce on an economy that has now shrunk 25% or more? Perhaps permanently?

For insurers, there isn’t a pause with coronavirus. In order to fulfill contracts, working from home is necessary for almost all. This has caused stress for workers and managers who 1) can’t change because they simply don’t have the skills necessary to meet the technology demands that remote work practically demands 2) those who don’t do jobs that can be handled remotely and 3) those who don’t have the tools because employers were not adequately modernized to enable remote work.

The implications aren’t limited to employees and insurers themselves, but include key partners like agents, brokers, reinsurers and outsource partners. Any of these may now represent key threats to operations and ultimately in meeting customers insurance needs. In most countries the pandemic threat has triggered government controlled response. With differing levels of coronavirus impacts and responses individuals and corporations don’t control operational outcomes. What this means for insurers is a key partner re-evaluation of risks vs. benefits in crisis situations.

This re-evaluation is going to be absolutely necessary, because for the insurance industry I don’t believe that the coronavirus is something that will go away. The resulting economic recession has the potential of prolonging the coronavirus impacts and even greater potential of permanently changing human behaviour forever. Nothing is off the table. If anyone is thinking “this will go away”, it won’t and I will show you why.

A New Age of Consumer Empowerment

Consumers have already been preparing themselves for permanent change for a long time. A 2019 insurance market analysis[1] found 78% of all personal auto policies have been shopped in the past 5 years. 45% of all policyholders who switched did so for $100 or less in savings. Interestingly, personal income levels weren’t a factor in shopping. Consumers are aware that they can switch with relative ease and save money.

That same study found that cost is the #1 reason for customers seeking alternatives in choosing auto insurers.

Further evidence of changing consumer behaviour has been evidenced in research by J.D. Power. A recent article[2] observes 3 key trends in insurance consumer behaviour.

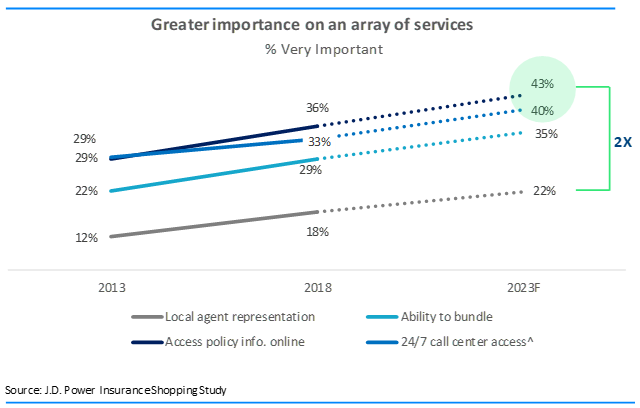

Consumers are demanding more than is currently available, particularly through the Agency distribution channel. Current trends indicate that access to policy information is the top ranked value add service for 36 out of 100 consumers (2018). This is trending to increase to 43 out of 100 in 5 years. In comparison, those numbers are double the number of consumers that rate local agent representation as the #1 value add. The second most coveted value added service now and will continue to be is 24/7 service.

Traditional broker/agency distribution is losing its traditional service advantage over direct channels due to their ability to make it easier for consumers to interact with them on their own terms. Integrating multiple agency systems with multiple insurer systems will always be a systems roadblock to improving customer service. As consumers demand lower prices and greater service this impediment will further weigh down the ability for the broker/agency channel to meet those greater demands.

Lastly, consumers are less dependent on brokers/agents in the sales process. Price and brand awareness are much greater considerations. Other shopping experiences are driving consumers to do their own research based on their own needs and find the channel that will best fulfill those needs. “Brand gets a shopper into the sales funnel, but a competitive price is necessary to get a shopper to purchase.”

Further evidence of the impact of the coronavirus pandemic on changing consumer behaviour is evidenced in a recent J.D. Power survey results report “Auto Insurance During COVID-19 – Premium Relief: Consumer Impact and Outlook”[3]. The report postulates that temporary premium relief from insurers, in the form of discounts and rollbacks, is not ensuring customer loyalty. Instead, there is a surge in insurance comparison shopping as customers look for greater premium relief. I have written about this before on the impact that Covid-19 is having on changing customer behaviour.

Consider the coronavirus a litmus test for your company. How are you doing? Are you able to operate efficiently now? How about forever?

[1] “Insurance Shopology” – White Paper, LexisNexis – 2019

[2] “The Future of Agency Distribution: Overcoming Headwinds” J.D. Power blog article by Colleen Cairns (March 14, 2020)

[3] Auto Insurance Customers Shop for Better Deals Even With Pandemic Rate Givebacks – Carrier Management April 22, 2020

Note: By submitting your comments you acknowledge that insBlogs has the right to reproduce, broadcast and publicize those comments or any part thereof in any manner whatsoever. Please note that due to the volume of e-mails we receive, not all comments will be published and those that are published will not be edited. However, all will be carefully read, considered and appreciated.